Hydr

How to improve invoicing

process for a company

operating in the UK market?

WEB APP

By implementing a decision engine, as well as transforming the traditional signup process, winning customers and verifying their invoices was reduced from several weeks to just 24 hours.

ABOUT PROJECT

About company:

Hydr’s technology enables 100% of invoice values to be funded within 24 hours. The company enables fast and stress-free payment under transparent conditions. Customers don’t encounter hidden costs – fees are fixed, the invoice process is transparent and simple to understand.

All thanks to invoicing software that verifies the customer, aggregates necessary data in one place and improves decision-making. In addition, the risks associated with funding open invoices are significantly reduced.

Mission of Hydr:

Hydr wants to eliminate payment terms for small businesses in the UK by providing them access to the cash tied up in unpaid invoices on their balance sheets, by getting them paid for those invoices within 24 hours of creation.

OUR WORK

Project Management

Frontend

Backend

QA

UX & UI

Product Design Workshops

PURPOSE OF COOPERATION

Development of a platform to facilitate signup, data aggregation and to streamline the invoice processing steps and payments.

THE CHALLENGE

Factoring services in the UK are considered expensive and unprofitable.

Nicola Weedall, Hydr co-founder

“Within the context of some rather old-fashioned suppliers out there, HYDR eliminates that requirement of paperwork to streamline the entire process end to end. Not just from the point of onboarding and receiving your money, but also for updating your accounting software. So the business owner who’s benefiting from the service has very little to do and therefore the saving of time as well as improvement of working capital is very significant for them.”

1. PROCESS

WORKSHOPS

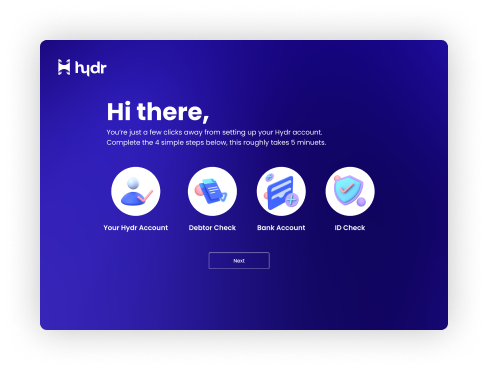

The collaboration with Hydr was preceded by a joint workshop in October 2020. The aim of that meeting was to develop actions to improve the process on the customer side and save time as much as possible. Equally important was to prepare the MVP and develop an onboarding scheme that would enable accurate verification of customers. The culmination of the agreed objectives was to automate the process using a special decision engine. After the MVP was successfully launched in June 2021, a second Railwaymen and Hydr workshop was held in October 2021 to clarify further objectives for the mutual collaboration.

COMMUNICATION & WORKFLOW

Communication with the client at each stage to date has been effective. We communicated via Slack messenger and held a project call together once a week. Additionally, along with each milestone, we presented a demo of the system.

Olgierd, Product Owner

“Integration with 7 external and different APIs can be really challenging, from the Project Management perspective. Thanks to meeting all of the requirements, we were able to create a scalable product that automizes many usually time-consuming manual actions and makes Hydr a competitive solution in the finance market.”

2. THE FEATURES

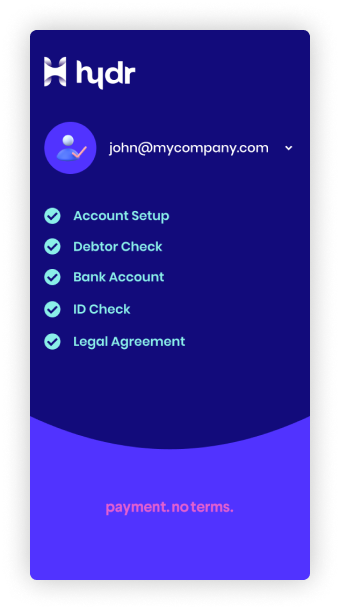

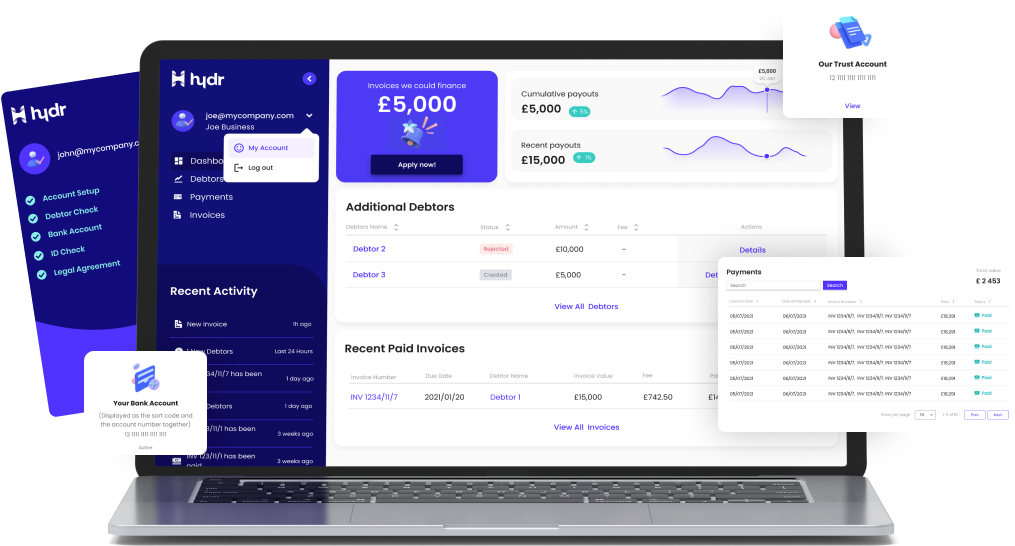

ONBOARDING

Customer verification is required to start the invoicing process. For this, a thorough onboarding process is required, which allows Hydr to make the final decision regarding invoice payment.

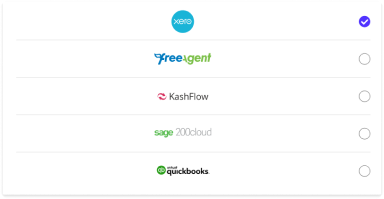

The onboarding we worked on together consists of 15 steps. The customer entrusts us with their bank and account details (Xero at launch, now QuickBooks, FreeAgent, Kashflow and Sage 200 Cloud)*. On the other hand, Hydr is responsible for verifying the client’s creditworthiness, verifying the accounts payable, the identity of the decision makers and ensuring that documents can be signed electronically.

Once the relevant data has been collected, the system carries out verifications, resulting in the final decision. The invoicing stage ensures ongoing checking of data, funding of invoices and insight into whether receivables are paid by the vendor invoice debtor.

* Customer data is protected against any outside interference. Only a limited number of people have access to it in order to ensure the highest security standards.

Konrad, Front-end Developer

“Despite my extensive experience, Hydr taught me a lot. Extensive, interactive forms as components in the Vue framework were quite a challenge. However, despite the complex business logic, working in such a nice team and with such great graphics was a pure pleasure for me.”

DECISION ENGINE

The decision engine collects the necessary customer data. Based on this data, it makes funding decisions. However, the final word belongs to the analyst, who checks the solution proposed by the system. This is an innovative approach compared to Hydr's competitors. In their case, analysts are responsible for most of the verification invoice approval process. Our approach allows us to offer far greater automation, leading to lower cost to serve and higher margins on the service. Individual reports are made for each client.

The decision-making system makes it possible to determine whether the customer meets all the conditions for cooperation. What's more, the engine makes it possible to check debtors individually.

Szymon, Back-end Developer

“New projects are an excellent opportunity to use edge-cutting tools and technologies. It was no different this time, as Hydr is one of our newest projects where we started using Vue.js as the main frontend technology, and personally I am really impressed with what we have achieved. Another aspect is a bigger than usual number of services which we need to integrate and keep active connection every day. That’s why this project is so engaging and gives us the possibility to present our skills.”

INTEGRATIONS

The implemented project contains as many as 7 integrations. One of them is cooperation with the Xero accounting software, which streamlines customer verification and the entire invoice automation process. The large number of integrations makes it possible to ensure the highest standards of customer security, verification and assessment of creditworthiness and identity.

Piotr, Back-end Developer

“From the very beginning, Hydr was a very challenging and exciting project – starting from workshops and understanding the mechanics of invoice financing, through designing user workflow to implementation. The biggest challenge was to synchronize information from all the external services. By taking advantage of technology innovations like open banking, connecting with accounting software etc. we manage to create a smooth onboarding process for end user and admin panel that provides a meaningful summary of collected data for administrators.”

3. TECHNOLOGIES & INTEGRATIONS

4. UX / UI

ONBOARDING

During the onboarding stage, we faced several challenges. One of them was the use of proven external integrations that allow for the secure transfer of sensitive data. In addition, we developed a solution whose role is to verify the company. Also important was the integration of the tool with the bank account and the accounting system. In the case of the accounting system, the company has the possibility of verifying the client, but also its customers, which has a great impact on the final funding decision. One element of the onboarding we created for Hydr is KYC (Know Your Customer), which allows us to verify a customer’s identity before signing a contract. This tool helps to rule out any potential fraud attempts. An important part of this process is the integration with HelloSign, which makes it possible to generate contracts to be signed by all directors. Contract generation limits existing manual data entry.

Sylwia, UX/UI Designer

“We started the project with intensive workshops that helped us understand the need to collect and analyze specific information, choose the best methods for capturing and presenting it, and define the goals and needs of the service users. The biggest challenge from a UX point of view in this project was to guide the user through the thorough registration and verification process, involving a number of integrations, handling feedback, and participation of additional users. Modeling this process was key to the first iteration of the project.”

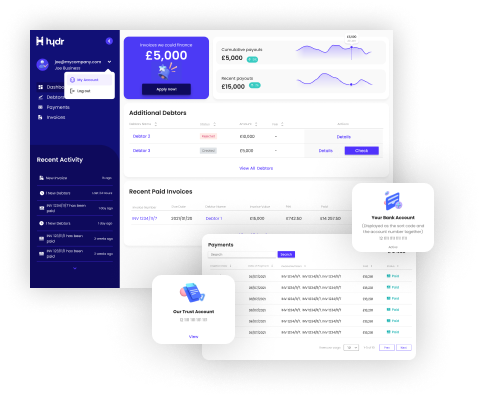

SIMPLE AND INFORMATIVE DASHBOARD

After the onboarding process, the customer is given access to the dashboard. The main features are the ability to select customers for factoring and to view processed invoices. This is the customer’s command center, where they can observe the various processes carried out by Hydr. In addition to access to current information, the business owner has the possibility to edit data in the dashboard.

Ania, UI Designer

“The project involved adapting the branding provided by the client to wireframes. The user has a few simple views, the most important of which is Dashboard. Dashboard is an Overview of key performance indicators. For example, users can see quickly how much invoices could be funded through Hydr’s technology, see the list of additional debtors and recent paid invoices. An additional feature we have added is a sidebar which can be shown and hidden. If the user wants to focus on the analysis of invoice tables, he can hide the menu and have more space to display table. Due to the growing role of mobile devices among British people, I also focused on making the product easy to use on mobile devices too.”

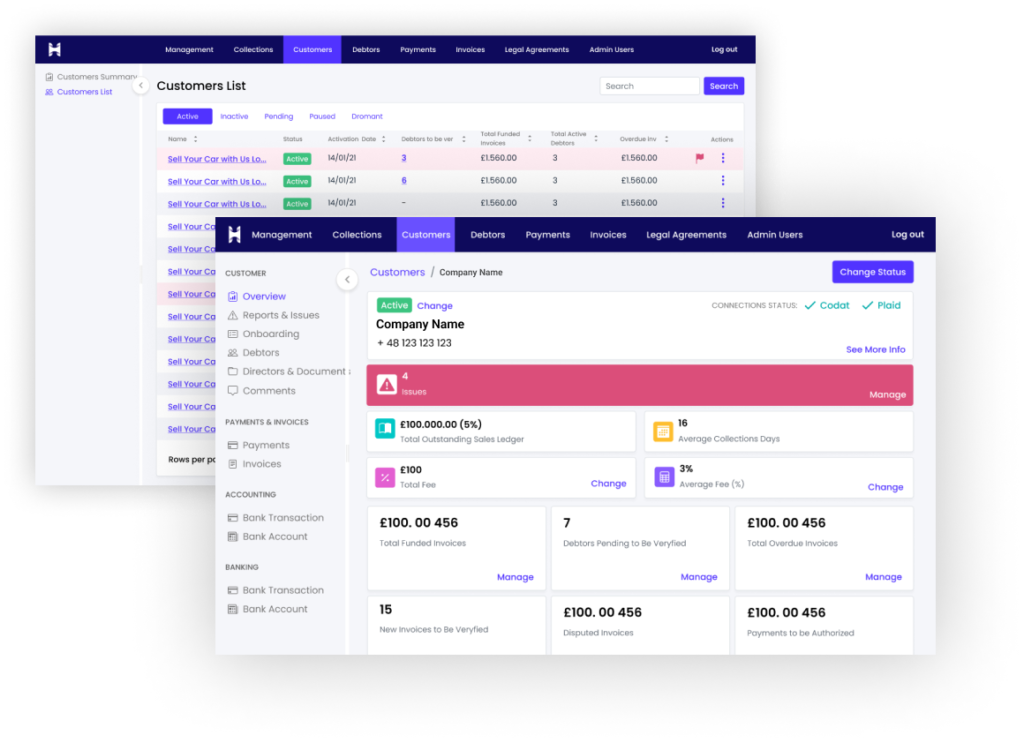

ADMIN PANEL

The first version of the system included an initial admin panel, which is now being extended with new functionalities. To this end, together with Hydr representatives during the workshop, we have established an action plan that includes further development. When the invoice, after verification, enters the payment process, a transfer basket is created. These are created by the system together with the managers. In future, this process will be subject to automation.

5. QA

The Quality Assurance process was as time-consuming as the front-end activities. Due to the handling of sensitive data on the customer side, we took care to ensure that it was properly secured at every stage. Equally important for us were integrations with e.g. banking automated invoice processing and accounting systems, which also required appropriate testing. The next stage of work will be actions connected with streamlining work in the admin panel.

Joanna, Quality Assurance

“Hydr testing was and still is, because the application is developing, divided into 3 parts: client onboarding, which required a lot of cooperation with the frontend developer, so that the user could feel trust in the product and security, because the application is related to finances and working on a large amount of sensitive information. The second part is testing the integration with several external services that require focus and detail due to the proper verification of the client and his debtors. The third part is the admin panel – the heart of the project, supervising the correct flow of decisions.”

FINAL PRODUCT

RESULTS & FURTHER DEVELOPMENT

The result of our efforts has been to shorten the standard factoring process, which for other companies is 14 days and longer. Hydr’s technology enables this to be completed in just 24 hours. Hydr's offering is much more competitive thanks to our joint efforts. By automated invoice processing, the number of analysts previously involved has been reduced. As a result, costs on the customer side have decreased. It's a real time and money saver that small businesses will especially feel.

Testimonial:

Well we went through a competitive tender process with three software development houses, all of whom were recommended to us from within our network. We chose Railwaymen because we feel like the projects that these guys had worked on before are very much in line with what we are trying to deliver. We’ve built a great rapport with the team, so Łukasz (Railwaymen CEO) was the person that we spoke to initially, and yet we just felt the right fit for us as a business of what we were trying to achieve.